FinEdge is a fintech company focused on providing innovative financial solutions for mortgage lenders. I was responsible for both the website design and all site content, with a focus on clarity, trust, and conversion.

The Challenge

Mortgage onboarding is complex and highly regulated. FinEdge needed a digital presence that would:

- Clearly communicate their value to lenders and borrowers

- Build trust through professionalism and clarity

- Differentiate their offering in a crowded fintech landscape

To address this, I conducted extensive research into the mortgage software industry—analyzing competitor sites, reading industry reports, and mapping the needs of both lenders and borrowers. This research-driven approach allowed me to prioritize features and messaging that would resonate with FinEdge’s target audience.

My Process

Discovery & Research

I began with a deep dive into the mortgage technology space, reviewing competitor platforms and reading up on the latest trends in digital lending. To ensure the project addressed real-world needs, I mapped out likely business goals and customer pain points based on industry research and best practices.

Key outcomes:

- Identified the most critical features for lenders (automation, compliance, borrower experience)

- Developed a content strategy focused on clarity, trust, and conversion

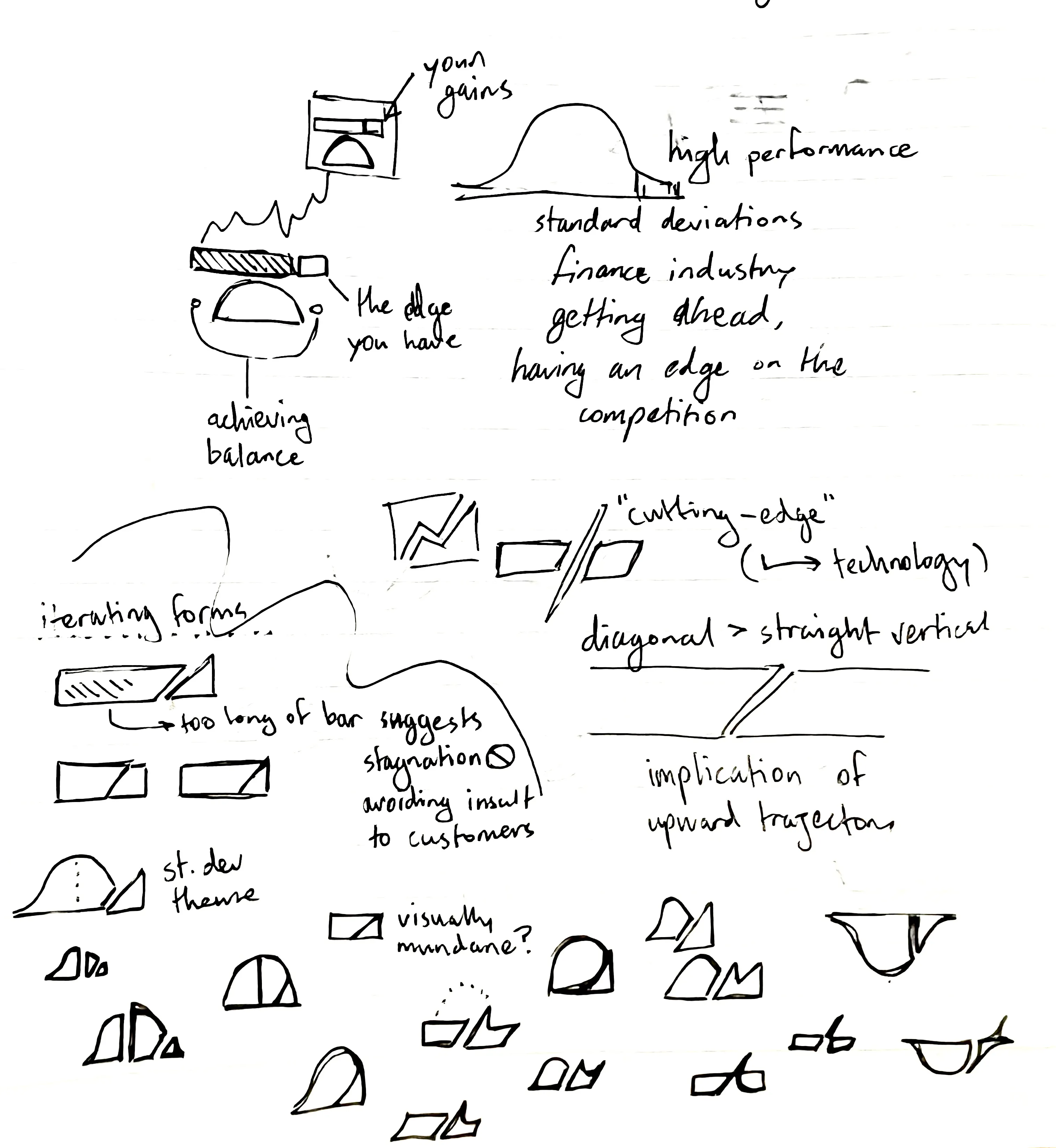

Logo Design Process

I approached the logo design with the goal of visually communicating the company’s technological edge and financial expertise.

Concept & Ideation

I wanted the logo to capture the idea of “getting an edge” on the competition—a concept that, in the context of finance, brought to mind the normal distribution graph (standard deviation). The end of this graph represents the small percentage that has “gotten ahead,” or the “edge.” This became a central visual metaphor for the brand.

Another phrase that inspired the creative direction was “cutting-edge” in reference to the innovative technology. I explored the idea of a slash through a shape, which evolved into a diagonal slash. Pointed upward, this slash also represents a growth curve.

Color Choices

For the color palette, I selected a dark blue to evoke security and professionalism, paired with a bright purple accent to represent premium quality, wealth, and innovation. Purple will stand out in the saturated market of Fintech, where most brands are just blue or green. The dark blue grounds the brand in familiarity, while the purple adds a modern, tech-forward touch.

Final Logo

The result is a logo that is sleek, sharp, and rich with references to both FinEdge’s values and their value proposition.

Site Design

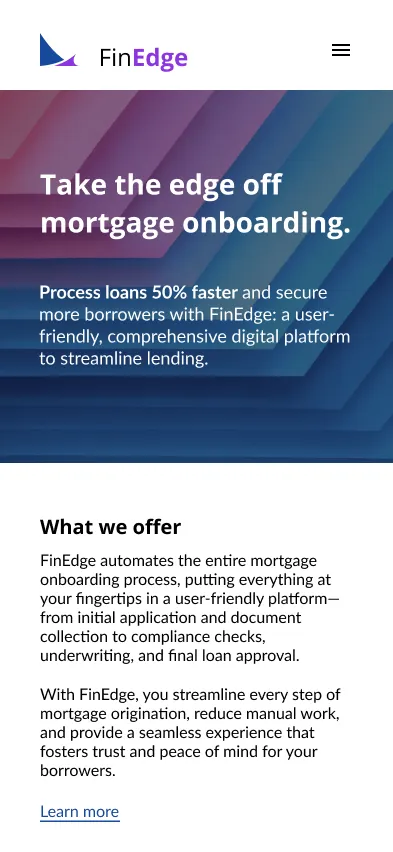

Landing Page

I crafted the landing page to immediately communicate FinEdge’s impact, featuring a prominent statistic and clear value proposition.

”We Are” Section

To humanize the brand and build trust, I designed a section that introduces the team and company values in a visually engaging way.

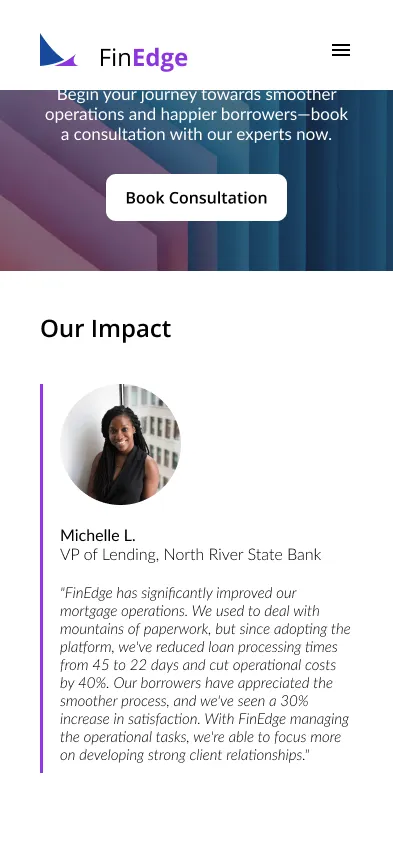

Impact Section

This section features a prominent customer testimonial, providing authentic, real-world proof of FinEdge’s impact. By showcasing measurable results and positive feedback from an actual user, the homepage immediately builds trust and credibility with prospective clients—reinforcing the platform’s value and effectiveness in a way that generic marketing copy cannot.

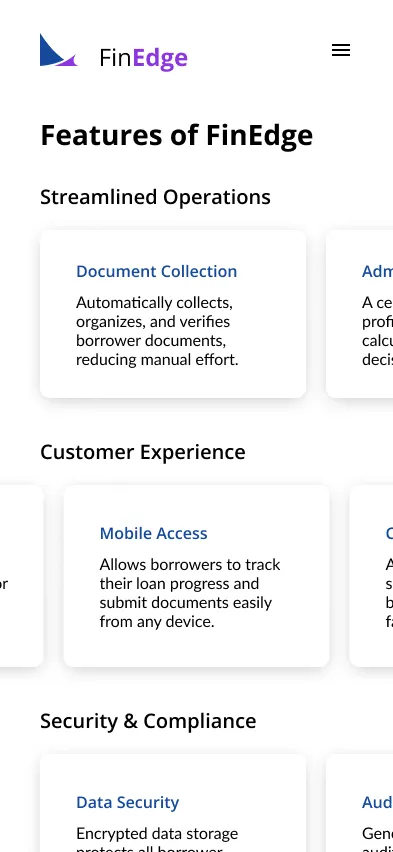

Features Breakdown

A key part of my work for FinEdge was to distill complex product capabilities into clear, benefit-driven content. Again based on my research, I outlined the content to highlight three pillars: operational efficiency, customer experience, and security/compliance. The key is concise, action-oriented copy and a structured, digestible format.

Operational Efficiency

- Document Collection: Automatically collects, organizes, and verifies borrower documents, reducing manual effort for staff.

- Administrative Dashboard: Centralized view of borrower profiles with visual tools and calculations for enhanced decision making.

- Real-Time Notifications: Keeps teams updated on application statuses, requests, and next steps, minimizing delays.

Customer Experience

- User-Friendly Interface: Provides borrowers with an intuitive digital interface for seamless touchpoints at every step.

- Mobile Access: Allows borrowers to track their loan progress and submit documents easily from any device.

- Communication: Automated updates and secure private chat keep borrowers informed with fast, secure messaging.

Security & Compliance

- Data Security: Encrypted data storage protects all borrower information, giving access only to authorized users.

- Audit-Ready Reporting: Generate comprehensive audit reports, ensuring compliance and reducing regulatory risks.

- Fraud Detection: Automated fraud detection tools identify red flags early.